Market Movements: Cap Program

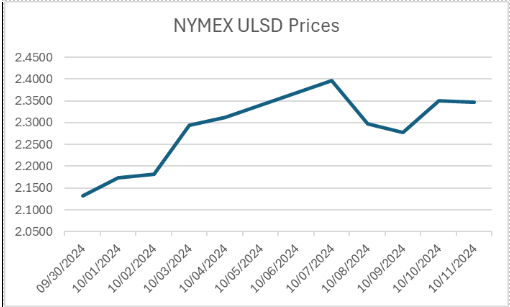

Energy prices continued on their volatile path last week. It was only two weeks ago; NYMEX diesel prices were in the teens but have now surged over $0.25 cents per gallon. In the month of September, NYMEX ULSD prices averaged $2.13 and as of early October, prices are averaging $2.30, with the month still underway.

As a fuel buyer, watching fuel costs swing wildly from month to month can be frustrating, especially when you're trying to manage a budget. In previous articles, we discussed how a company can control profit margins using a fixed-price contract. However, the challenge with fixed-price contracts is that they're obligations. This means when you enter into a fixed-price physical contract, you're committed to buying a specific amount of volume of fuel at the agreed-upon price, regardless of whether you actually need that much fuel or if market prices change. So what about companies whose volumes vary from month to month? What tools can they employ to manage their fuel prices? This is where a cap program can help.

A cap program, sometimes called a call option, is a type of contract that allows a company to set a maximum price for diesel or gasoline while retaining the flexibility to participate in downward price moves. The participant pays a premium to secure price protection. Cap programs are often compared to insurance contracts because the premium a company pays is influenced by the level of protection a company receives. Think of cap premiums like a deductible. The higher the deductible (more favorable or lower cap protection price), the more expensive the insurance contract, and the lower the deductible (less favorable or higher the cap protection price), the less expensive it is.

In a cap program, volumes are handled differently than in a fixed-price contract. As previously stated, a fixed-price contract obligates a company to take delivery of every gallon specified in the contract. In contrast, a cap program requires paying a premium on the volumes, but if the company doesn’t need all the gallons, the only cost is the premium.

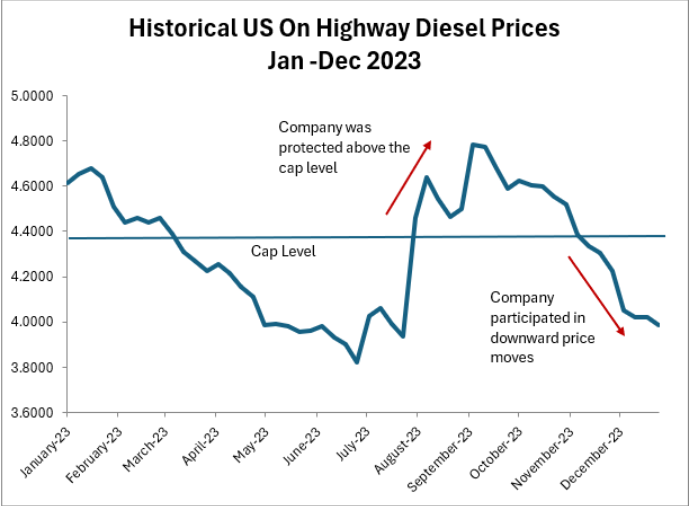

To illustrate the benefit of a cap program, consider this real-world scenario from the trucking industry.

In the summer of last year, a mid-sized trucking company explored ways to manage the risk to higher prices. The company's management decided to implement a cap program for 50% of their expected fuel usage over six months. The upfront premium for this cap was approximately $0.10 cents per gallon.

Two months into the program, prices increased due to concerns around diesel supply. For the capped portion of their fuel, the company was paying $0.40 cents less per gallon than the market price.

However, the market soon experienced an unexpected shift. Due to factors including warmer-than-anticipated winter weather and increased production, diesel prices fell. In this scenario, the cap program demonstrated its flexibility. The company purchased at the new, lower market rates for the uncapped portion of their fuel needs. The company also participated in downward price moves minus their premium for the capped portion.

While this example demonstrates a successful application of a fuel cap program, it's important to note that outcomes can vary significantly based on market conditions. Companies considering cap programs should carefully weigh the potential benefits against the guaranteed costs and their specific risk tolerance.

Diesel prices tend to be volatile during the winter heating season.

Contact your Colonial Oil representative to learn more about Colonial’s Price Risk Management programs.

Ready to find out more?

Subscribe today and make informed decisions!