Market Movements: Caps and Collars

Another Volatile Week in Prices

Oil markets have been on a wild ride over the past two weeks, with prices falling due to global supply concerns despite the cloud of uncertainty looming over geopolitics. Here's what happened.

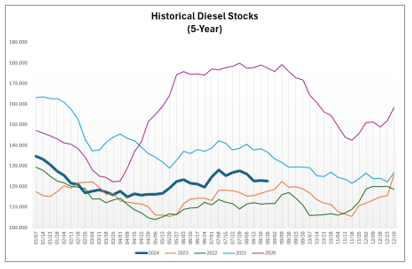

Rising oil prices, triggered by dovish comments from Jerome Powell, saw WTI Crude jump to $77.60 per barrel early on. However, the trend was short-lived as prices began to retreat, ending the two weeks lower due to concerns about an economic slowdown, August job numbers, and weak demand, especially from China.

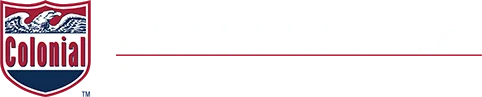

The EIA numbers showed a twelve-week decline in crude oil and a four-week decline in diesel inventories. Diesel stocks are currently 10 percent below their five-year average.

Last week also saw OPEC+ announce delays in tapering production cuts, pushing them back by two months while Libya’s political instability weighed on production. Russia saw a slump in diesel and gasoline exports to China, and by the end of the shortened Labor Day week—on the back of a mixed August jobs report—WTI fell below $70, at one point reaching a fourteen-month low of $67.17.

As a positive for those concerned about fuel price risk, despite OPEC + and an almost 7-million-barrel drop in inventories, markets are reaching multi-year lows, presenting opportunities to lock prices. Customers have typically used Fixed-Price contracts to lock in prices, but as we know from our recent webinar series, Fixed-Price contracts aren’t the only tool available to consumers.

Caps: Your Fuel Price Insurance Policy

A Cap is like an insurance policy for fuel prices. No matter how high the market goes, it sets a ceiling on how much a company will pay for fuel. Here's how it works:

- Choose a maximum price you're willing to pay for fuel – for example, $2.75 per gallon.

- Pay an upfront premium – prices vary on protection level.

- If fuel prices rise above $2.75, you're protected. You'll never pay more than your cap price plus the premium.

- If prices stay low, you pay the market price plus your premium.

Companies typically will set their cap at or below their budget levels.

If premium costs are a concern, the Costless Collar is another tool in the price protection toolbox.

Costless Collars: The Goldilocks of Fuel Pricing

A collar (also called a range) sets a ceiling and a floor on fuel prices. It's a balanced approach that protects you from extreme highs while letting a company benefit from moderate price drops. Here's how it works:

- Set a maximum price (the cap) and a minimum price (the floor). For example, $2.55 and $2.19 per gallon.

- If prices rise above $2.55, the company is protected –the maximum the company will pay for fuel.

- If prices fall below $2.19, you'll still pay $2.19 – the minimum a company can pay in downward price moves.

- Between these two points, you pay the actual market price.

To make Collars costless, the premium a company pays for the cap is offset by selling the floor protection.

Choosing the Right Strategy for You

Selecting the best hedging approach isn't one-size-fits-all. It depends on your business needs, risk tolerance, and market outlook. Here's a quick guide:

- Use Caps when prices are high or very volatile. The premium you pay could prevent much bigger losses if prices spike.

- Consider Costless Collars when you expect prices to stay within a range. They offer balanced protection without upfront costs.

- Opt for Fixed-price contracts when fuel prices hit historic lows. It's your chance to lock in great rates for the long term.

Remember, the fuel market is constantly changing. What works best today might not be ideal tomorrow. That's why staying informed and working closely with your Colonial supply rep is crucial to adjust your strategy as needed.

The weeks ahead:

September 12 (Thursday):

- US Unemployment Claims

- US Core Producer Price Index (PPI) and Producer Price Index (PPI)

- Interest Rate Decision (European Central Bank)

September 17 (Tuesday):

- US Retail Sales (August)

- US Industrial Production (August)

September 18 (Wednesday):

- US Building Permits (August)

- US FOMC Meeting: Market expecting 25-50 basis point move.

Ready to find out more?

Subscribe today and make informed decisions!