Market Movements: Volatile Week Driven by Geopolitics, Inventory Data, and Economic Signals

Price Movements

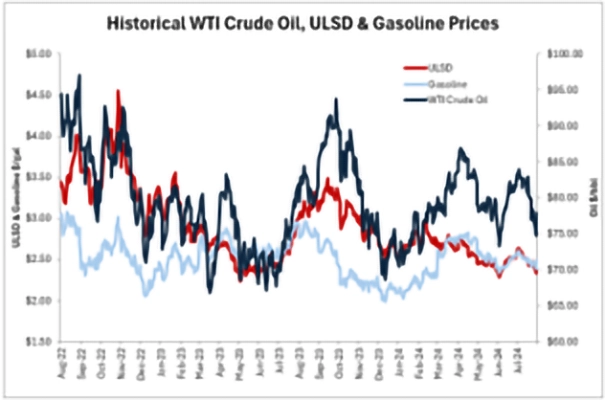

The energy markets saw significant volatility this week. WTI crude started the week near $77 a barrel, dipped to $74 on Tuesday, and then surged to nearly $79 before retreating back to below $77 by week's end. This pullback came after data revealed the largest drop in US manufacturing activity in eight months, sparking concerns about weakened crude demand. Reports of Iran planning retaliation against Israel further fueled fears of a broader conflict involving the US and Iran. Despite these tensions, analysts suggest the recent oil rally is overextended without significant global supply disruptions. Diesel and gasoline prices mirrored these trends, with ultra-low sulfur diesel closing Thursday at $2.4064 and gasoline at $2.3980.

Inventory Data

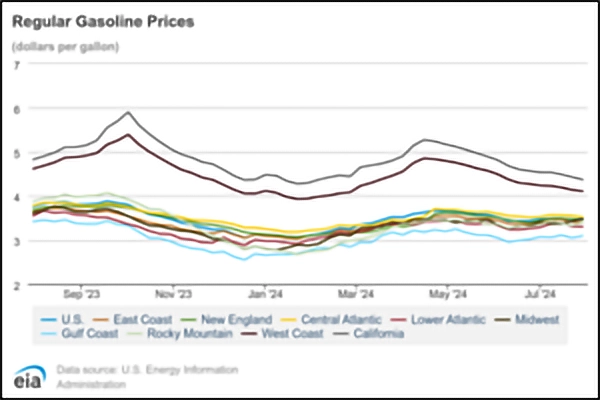

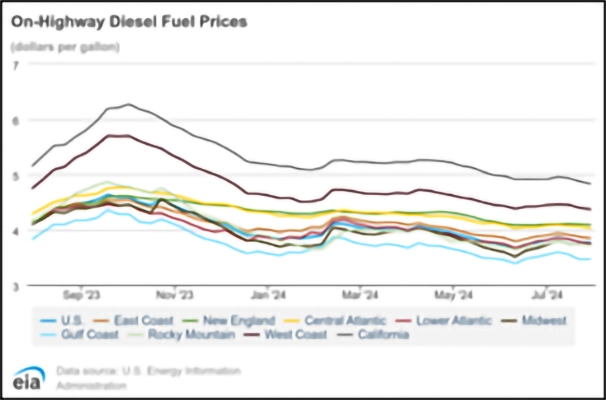

For the week ending July 26, 2024, U.S. crude oil refinery inputs averaged 16.2 million barrels per day, a decrease of 258,000 barrels per day from the previous week, with refineries operating at 90.1% capacity. Gasoline production declined while distillate fuel production increased. Crude oil imports rose to 7.0 million barrels per day, up 82,000 barrels per day from the previous week. Commercial crude oil inventories fell by 3.4 million barrels to 433.0 million barrels, about 4% below the five-year average. Gasoline inventories decreased by 3.7 million barrels, while distillate fuel inventories increased by 1.5 million barrels. Total commercial petroleum inventories decreased by 2.4 million barrels. The four-week average for total products supplied was 20.5 million barrels per day, up 1.4% year-over-year, with increases in gasoline (4.2%), distillate fuel (3.2%), and jet fuel (1.2%) demand compared to the same period last year.

Geopolitical Factors

Tensions in the Middle East continued to influence market sentiment. Reports of an Israeli strike on a Hamas political leader in Lebanon and subsequent calls for retaliation by Iran have heightened concerns about potential supply disruptions. While crude prices haven't reacted as sharply to these developments as they might have in the past, there's evidence of increased hedging activity. Brent Oil call option volumes reached their highest levels since early June, indicating that traders are preparing for potential further conflict*.

*A call option is an instrument that gives the holder the right, but not the obligation, to buy an underlying fuel at a specified price within a certain time period. Companies use call options to hedge against potential price increases. To learn more about call options, be sure to attend our Advanced Hedging Strategies webinar on August 20th, 2024.

Economic Indicators and Federal Reserve Signals

The Federal Reserve's latest communications suggest a move towards lowering interest rates, citing easing inflation and a cooling labor market. This shift in monetary policy outlook has generally supported risk appetite across markets, including oil. The potential for increased economic activity due to lower interest rates could boost fuel demand in the coming months.

Market Sentiment Analysis

Our latest analysis reveals a complex landscape where bullish and bearish factors are closely balanced:

Bullish Factors:

- OPEC+ production quotas

- Robust Chinese demand

- Ongoing geopolitical risk premium

- Declining U.S. crude inventories

Bearish Factors:

- Economic slowdown concerns

- USD strength

- Non-OPEC production growth

- Record high U.S. crude production

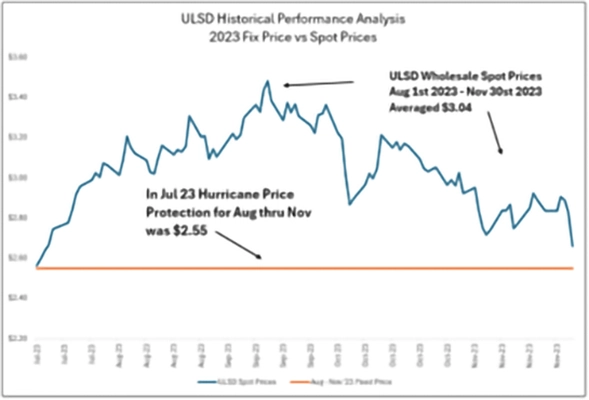

Hurricane Season Preparedness

As we enter the peak of the Atlantic hurricane season, fuel buyers should consider their risk management strategies. Historical data demonstrates the value of locking in prices ahead of potential storms.

For example, buyers who secured fixed prices for ULSD in July 2023 for the August-November period locked in at approximately $2.55 per gallon, realizing average savings of $0.49 per gallon compared to spot market fluctuations.

The National Hurricane Center is currently monitoring a disturbance near the Bahamas and Florida that could develop into a tropical depression or storm by the weekend. While its potential impact on the U.S. East or Gulf coasts remains uncertain, it serves as a reminder of the importance of preparedness in the fuel industry.

Colonial's Capabilities

Colonial Oil Industries offers comprehensive solutions to help clients navigate the uncertainties of hurricane season:

- Strategic Rail Assets: Terminals in Savannah, GA, Garden City, GA, and Wilmington, NC, with capacity for over 40 railcars (1 million gallons) during emergencies.

- Extensive Truck Fleet: 50+ Tank Wagons and 150+ Tanker Trucks providing service in 34 states.

- Wholesale Bulk Supply: Access to owned terminals and pipeline supply, distributing approximately 330 million gallons per month.

- Barge Units: Marine terminal access in 12 Atlantic terminals from Baltimore, MD, to Tampa, FL, with the latest barge capacity at 1.2 million gallons.

- Fixed-price program: This program offers protection against market volatility, allowing businesses to lock in prices and ensure supply security.

Looking Ahead

As we move into next week, market participants should monitor:

- Further developments in Middle East tensions

- Upcoming economic data releases

- Any shifts in OPEC+ rhetoric or policy

- Tropical weather developments in the Atlantic

The interplay between these factors will likely continue to drive market volatility in the short term. Strategic planning and risk management are crucial for fuel buyers and distributors in this uncertain environment.

Until next time…