Reflecting on Past Presidential Administrations’ Impact on Oil Prices

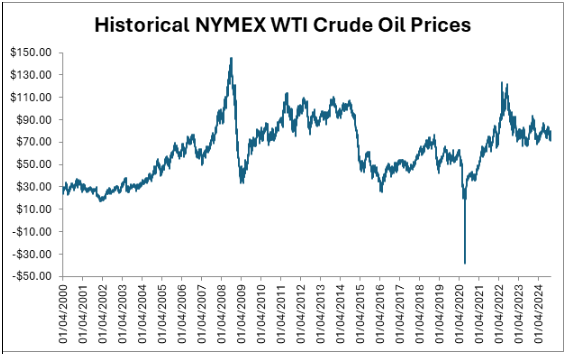

This week, WTI crude oil prices fluctuated within a range – from $71.46 to $75.01 per bbl - as the market recovered from the start of a wild August. By Friday, the focus was on Federal Reserve Chair Jerome Powell's statements, in which he hinted at interest rate cuts during his speech at the Jackson Hole Symposium.

It’s not a coincidence that crude oil ended up almost 3 percent higher. Fiscal policy can have a direct and indirect relationship with oil prices, often driving short-term price movements that can seem erratic and unpredictable.

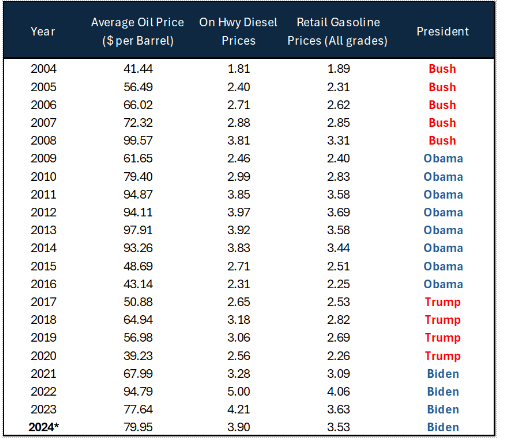

As we look ahead to another election season, customers are asking, “How is the election going to affect my fuel costs?” While it’s tempting to predict oil prices based on policies, historical analysis shows that oil prices have been prone to fluctuations regardless of who sits in the White House.

Reflecting on Past Presidential Administrations' Impact on Oil Prices

President Bush

During George W. Bush's time in office, oil prices remained relatively stable. However, the stability didn’t last. The Iraq War in 2003 saw prices move from $25 per bbl, and it didn’t look back. Hurricanes Katrina and Rita in 2005 disrupted oil production and refining in the Gulf, catapulting prices.

The peak occurred in 2008 when oil prices surged to $140 per bbl due to demand from China and supply concerns. The global financial crisis that followed caused a major price drop, highlighting the connection between oil markets and broader economic conditions.

President Obama

Barack Obama's presidency marked a shift in the oil industry. Following the financial crisis - as the economy bounced back - oil prices recovered. Then, the landscape changed with the shale boom. Innovations in Hydraulic Fracturing or commonly know as Fracking and horizontal drilling allowed oil and gas extraction from shale formations, transforming the industry.

By the mid-2010s, the United States had become a major player in oil production. This increase in supply put downward pressure on oil prices starting in 2014 and persisted throughout Obama's presidency.

President Trump

The oil market experienced a blend of stability and unexpected fluctuations throughout Donald Trump's presidency. However, it’s not an exaggeration to say everything changed during the COVID-19 pandemic in 2020. The world experienced an unprecedented decline in oil demand. Lockdowns and economic slowdowns triggered a global plunge in prices, and Crude prices went negative in April 2020—yet another demonstration of how global events can disrupt the market.

President Biden

Under Joe Biden's presidency, the focus has been on the transition to renewable energy. Despite these efforts, global incidents have continued to impact market stability. For example, the Russian invasion of Ukraine in 2022 caused disruptions in energy markets, resulting in price spikes in diesel fuel as VLCCs bound for the US were redirected to Europe. Ongoing geopolitical tensions in the Middle East continue to keep prices volatile.

Prices Fluctuate

The bottom line is that oil prices have fluctuated across different administrations. This is why it’s important to have a plan to handle fuel price uncertainties. At our most recent webinar, Advanced Fuel Hedging Strategies, we shared ways companies can mitigate their risk of rising oil prices. A recording of that webinar is available. Reach out to your Colonial Oil representative for more information.

Until next time….

A look ahead:

- Consumer Confidence (Aug 27)

- Weekly Petroleum Numbers (Aug28)

- Initial Jobless Claims (Aug 29)

Ready to find out more?

Subscribe today and make informed decisions!