Unexpected Twist: Oil Prices Rally on Fed Rate Cut

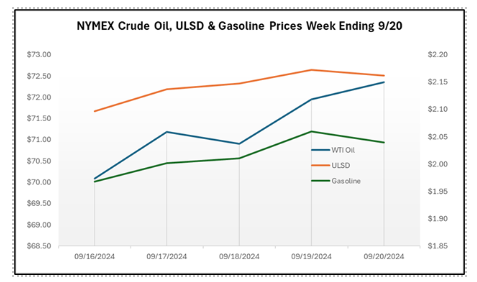

The oil market started soft but rallied towards the end of the week, supported by the Federal Reserve's decision to cut the key interest rate by 0.5% during the FOMC meeting on Wednesday. Tightening U.S. crude supplies and rising geopolitical tensions helped push WTI from $69 to $72 per barrel, while Brent crude gained around $2 per barrel.

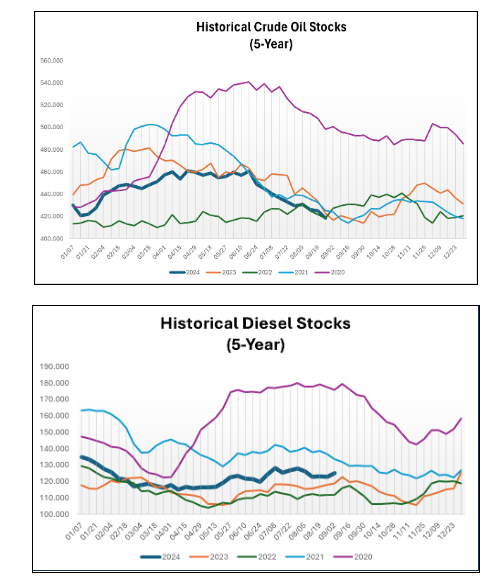

On the supply side, we saw U.S. crude inventories hit a 12-month low with a 1.63-million-barrel draw. Gasoline inventories stayed elevated, especially on the East Coast, but diesel prices performed well due to supply disruptions in Europe tied to refinery maintenance, and the aftereffects of Hurricane Francine still holding back production in the Gulf of Mexico.

On the demand side, China’s latest economic data continued to disappoint, with weaker-than-expected industrial output and retail sales. While the report questioned future demand from the world’s largest oil importer, it wasn’t enough to offset the market's upward momentum.

Meanwhile, the broader economic mood was positive—the S&P 500 hit a record high following the Fed’s rate cut. At the press conference following the rate decision, Fed Chair Powell injected a bit of caution into the excitement by suggesting that future rate cuts may not come as quickly as the market might hope, which led to some retracement late in the week.

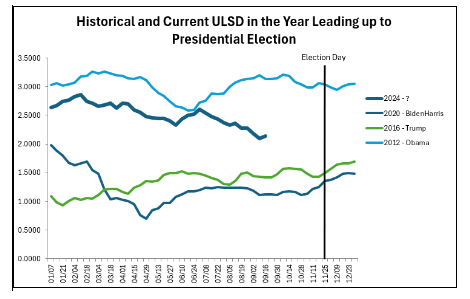

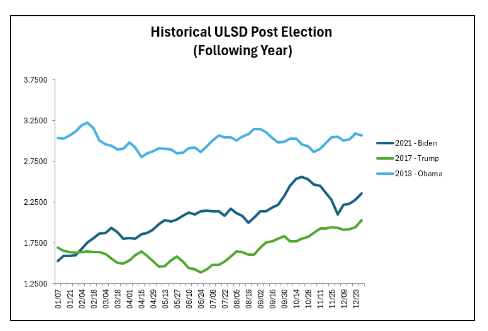

Looking ahead to 2025, we’ve noticed a growing trend among our clients to lock in fuel prices. Of course, with an election coming up, there's always hesitation. But here’s the reality: oil prices are volatile, no matter who sits in the Oval Office. To underscore this point, I’ve put together a chart that tracks diesel prices before and after the elections of Obama, Trump, and Biden.

The first chart shows how diesel prices moved in the year before the election, and the second shows how they behaved in the year that followed. While elections are a factor, prices tend to fluctuate much more based on supply disruptions, demand swings, and geopolitical events.

It reminds me of what William Goldman, the great screenwriter, once said: “Nobody knows anything.” Sure, he was talking about predicting the next Hollywood blockbuster, but it applies just as much to the oil markets. We can’t predict prices, but unlike Hollywood, you can protect yourself from price hits.

If you're considering locking in prices for 2025, contact your Colonial Representative to discuss the best strategy for safeguarding your business and navigating these unpredictable times.

Ready to find out more?

Subscribe today and make informed decisions!